How Do You Get Your Fast Track Bonus

Fast Track Starter & Saver Accounts

- What is a Fast Track Account?

The BOQ Fast Track account is our high interest savings account, designed to put more money back in your pocket! With Bonus Interest to be earnt for your monthly deposits, our Fast Track savings account is one of the most competitive in the market and one of the best steps you could take towards achieving your savings goals. Our Fast Track Saver is smartly linked to your Day2Day Plus transaction account which is best suited for your everyday spending. So in this way, you'll have two linked accounts for each purpose – your spender, and your saver. Perfect!

Where your Fast Track savings account will reward you for SAVING, your Day2Day transaction account will reward you for SPENDING, so don't be shy and enjoy a little of both!

- What do I need to know before I open a Fast Track Savings Account?

- To earn Bonus Interest and more dollars in your Fast Track savings account, you'll need to meet what we call 'Bonus Criteria' – to learn a little more about what that is, hop down to the next question.

- Bonus Interest is only earned on balances up to $250,000, so if you've exceeded this amount, well done you – we can help you make the most of your money in other ways, so always check-in with us to make sure your money is working hard for you!

- Our awesome everyday spend Day2Day Plus transaction account will be automatically linked and opened for you when you open your Fast Track Account. In addition to no account maintenance fees, our Day2Day Plus account can offer you a whole other set of benefits when you use it for your day-to-day spending. To know more about your Visa Debit Cardholder benefits follow this link.

Of course, if you've already taken out a Day2Day Plus account with us, we will simply link it up for you to your Fast Track account, so you can enjoy benefits whether you're spending or saving!Apply Now

- How do I qualify for Bonus Interest?

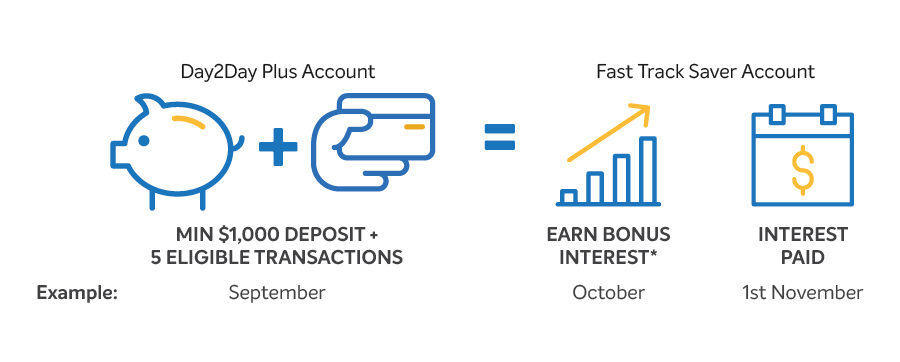

Here's an example of how your BOQ savings account works! To make the most of your money and earn that Bonus Interest, you need to deposit a minimum of $200 for the Fast Track Starter Account or $1000 for the Fast Track Saver Account into your linked Day2Day Plus account before the end of every calendar month (if you're not yet sure of the difference between our saver and starter accounts – just jump to the question below). In addition to this, you will also need to make 5 eligible transactions such as settled (not pending) Visa Debit Card or eftpos purchases, ATM withdrawals or direct debits from your linked Day2Day Plus account.

Interest is paid on the first of each month for the deposit made in the prior month; so if you want to earn your Bonus Interest in July, you need to have made your deposit by the end of June.

The deposit must be from an external source – meaning, amounts transferred from any other BOQ account that you may be associated with into your Day2Day Plus will not count. A payment from your employer or money from mum, does!

Have a read of the non-eligible transaction list below so you are aware which transactions to not count for example BPAYs.

Because Bonus Interest is earned based on the deposits made in the previous month, the funds in your Fast Track savings account will only be eligible to earn the Base Rate for the month you opened it. You will also only earn the Base Rate in any other month if you don't meet the Bonus Criteria. Hop down to the question about Base Rate to learn more about earning the Base Rate.

Tip: If you're ready to start sending your pay to your Day2Day Plus account, you can use this Salary Transfer Request Form to let your employer know your account has changed and switch your direct debits by using our simple Switching form.

- Who is eligible to open a Fast Track Account?

Okay, here's the criteria you'll need to meet before you can apply online:

- You need to be 14 years or over. If you're 14 – 24, we'll open a Fast Track Starter for you. If you're over 25 it'll be the Fast Track Saver!

- You need to be an Australian citizen or permanent resident.

- You must be applying for yourself and not in the name of a business or trust – there should be no more than two account holders for this account. If you are looking for a similar product for your business, take a look at our Business Performance Saver account.

Apply Now

- How is interest calculated on my Fast Track Account?

Interest is calculated on the daily closing balance of Fast Track Accounts using a stepped rate of interest. This means that different rates of interest apply to different parts of your account balance. Interest is calculated from and including the day that funds are deposited to your account on the daily balance in your account.

For the current interest rates and tiers, please check our Personal Deposits- Interest Rates Flyer.

Interest is paid on the 1st day of the following month. Please check your account on the 2nd day of the month to check out the interest you have earned.

Refer to section 2.10 (c) of Deposit Products Terms and Conditions for the interest calculation formula and worked example.

- What is a Pending Transaction?

When you look at your account balance on Internet Banking or Mobile Banking, your available balance may be lower than your current account balance. This is because some transactions may be held as pending and are yet to settle.

Pending transactions generally take between 3 to 5 days to appear on your statement, which confirms your transaction is settled but may occasionally take longer. If the transaction isn't processed within 5 days, the pending transaction amount will be returned to your available balance. However, the Merchant may still process the transaction after that date, which will reduce your account balance and the transaction will appear on your statement at that later date. This may occur when using your Visa Debit Card via Tap To Pay, or by selecting credit (CR) at a Merchant terminal or an online/phone purchase.

You should make sure that you check your available funds regularly to know how much money you have in your account.

- What transactions on my linked transaction account count towards the 5 eligible transactions?

Here's a list of transactions that will count towards your five (5) eligible transactions:

- Direct debits (e.g. your gym membership or insurance)

- Card purchases – using your eftpos card (access card) or Visa Debit Card

- ATM withdrawals – using your eftpos card (access card) or Visa Debit Card

- Any online purchases using your Visa Debit Card

Note: Visa Debit Card transactions must be settled transactions (i.e. not pending) to be eligible. The transaction must display on your linked transaction account statement for the month you're aiming to meet your Bonus Interest eligibility criteria. If a transaction does not settle in the relevant month, the transaction will be counted in the following month.

Looking for more information on pending transactions? Take a look at our FAQs.

- What transactions on my linked transaction account do NOT count towards my 5 eligible transactions?

Here's the transactions that won't count towards your five (5) eligible transactions:

- Deposit transactions (counted towards the minimum deposit criteria)

- Cheques written or deposited

- Use of BOQ Credit Card

- Branch cash withdrawals

- Transfers or payments toany bank account via Internet Banking, branch or ATM. (So things like international money transfers, or a simple transfer to a BOQ account or any other financial institution will not count as an eligible transaction).

- BPAY payments

- Any pending Visa Debit Card transactions (remember if the transaction HASsettled and showing on your account statement, this WILL count as an eligible transaction).

- How do I know how many transactions I have made?

You can regularly check your account transaction list or history on your Internet Banking or Mobile Banking. The settled transactions will show on these list so ensure the 5 eligible transactions are completed within the relevant month.

- When will I earn Base Rate and not Bonus Interest?

You'll earn the Base Rate interest on your Fast Track Account funds:

- The month you have opened your account;

- If you fail to meet the Bonus Criteria;

- On balances over $250,000.

- What should I do after opening my Fast Track Account?

To get started, see all our useful information on getting started at BOQ.

In the meantime, here's some other helpful bits 'n' bobs to get you on your way with your Fast Track savings account

- Not logged in yet? If you're unsure how to access your accounts via our Internet Banking, check out this video.

- Ready to start earning bonus interest? You can arrange for your salary to be sent to your linked BOQ Day2Day Plus using our Salary Credit Form. While you wait for your next salary, make sure you have made an eligible deposit by the end of the month to meet the Bonus Criteria for the following month. You are also required to make 5 eligible transactions so start tapping away with your Visa Debit Card, just ensure its 'settled' and comes through your account statement for the relevant month.

- Setting up? Switch your payments to your linked BOQ Day2Day Plus by following these easy steps here and make the direct debits count towards the eligible transactions.

- Ready to activate? Activate your Visa Debit Card now linked to your Day2Day Plus and enjoy the Visa Offers & Perks!

- What will happen when I turn 25 years old?

If you're aged between 14 and 24 and already have a Fast Track Starter, then your account will automatically convert to a Fast Track Saver when you celebrate your 25th birthday, meaning the Bonus Criteria will change and the new eligible amount to earn Bonus Interest will be $1,000.

So, if you turn 25 on say the 14th day of September, your account would be automatically converted to a Fast Track Saver for the month of October and so you need the eligible $1,000 deposit to be made into your Day2Day Plus savings account in the month of September to earn your Bonus Interest.

- Will I always receive the high interest rate?

Interest rates on these accounts are a variable rate of interest and may change without notice – you can keep up-to-date with our current interest rates here.

- How many Fast Track accounts can I have?

Fast Track Accounts are restricted to one per customer i.e. one jointly or solely.

How Do You Get Your Fast Track Bonus

Source: https://www.boq.com.au/help-and-support/faqs/fast-track-faq

0 Response to "How Do You Get Your Fast Track Bonus"

Post a Comment